Rent or Buy? A Guide to Mobile Crusher Decisions Based on Throughput and Project Duration

This article provides a comprehensive analysis for businesses facing the critical choice of whether to rent or purchase a mobile crusher. The decision hinges primarily on two key parameters: the expected material processing rate, known as throughput measured in tons per hour, and the total length of the project. We will examine how these factors interact with financial considerations, operational flexibility, and long-term strategic goals. By understanding the trade-offs between immediate costs and future benefits, companies can make informed decisions that optimize their resource allocation and enhance project profitability.

Core Factors in the Rent or Buy Decision Overview

The choice between renting and buying a mobile crusher involves a fundamental balance between capital expenditure and operational needs. Throughput requirements dictate the necessary scale and capability of the equipment, while the project timeline directly influences the total cost of ownership. Short-term engagements often favor the flexibility of rental agreements, whereas long-term operations may find ownership more economically viable. Additional elements, such as maintenance responsibilities and the pace of technological advancement, further complicate this strategic decision.

The Role of Expected Throughput

Throughput is a critical performance indicator that defines the required capacity of a crushing system. A higher throughput target often necessitates a more powerful and sophisticated machine, which significantly impacts both rental rates and purchase prices. The selection of an appropriately sized crusher is paramount to achieving production goals efficiently.

Understanding the relationship between throughput and equipment specification helps prevent over-investment in underutilized machinery or costly bottlenecks from an undersized unit. Accurate assessment of material characteristics and desired output size is essential for matching the crusher's capabilities to the project's demands.

The Criticality of Project Duration

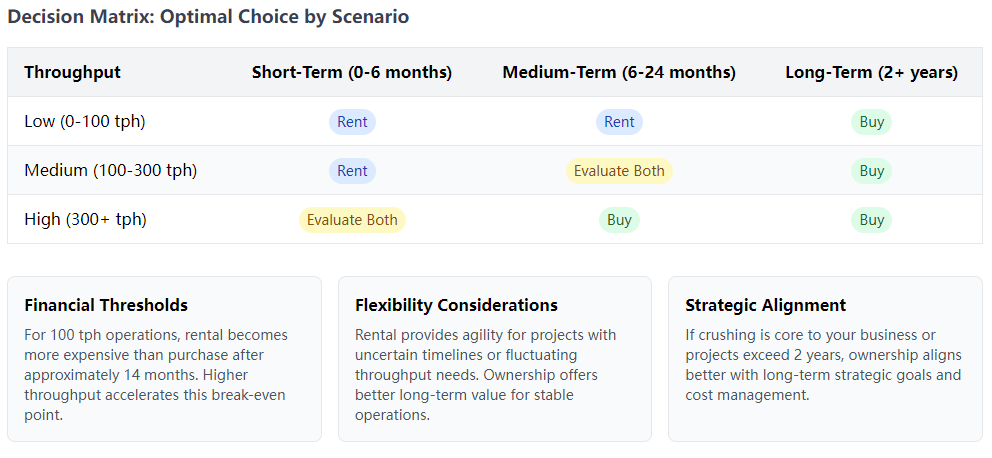

Project duration serves as a primary determinant in the rent-or-buy calculus. Projects lasting less than six months are typically well-suited for rental arrangements, as they avoid the long-term commitment and potential idle time associated with ownership. For endeavors extending beyond two years, the cumulative cost of rental payments often exceeds the initial investment of purchasing the equipment.

Predicting the exact project timeline can be challenging, and unexpected extensions are common in industries like construction and mining. A decision model must account for this uncertainty, favoring rental for its inherent flexibility when schedules are volatile or poorly defined from the outset.

Impact of Initial Investment and Cash Flow

Purchasing a mobile crusher requires a substantial upfront capital outlay, which can strain a company's liquidity and limit its ability to fund other opportunities. This significant initial investment includes the machine's price, transportation, and installation costs. For many businesses, preserving cash flow is a top priority.

In contrast, renting a crusher transforms a large capital expense into a predictable operational expenditure spread over monthly payments. This approach conserves working capital, allowing it to be deployed toward areas like labor, fuel, or other critical project components, thereby improving financial agility.

Comparison of Flexibility and Risk

Renting offers unparalleled flexibility, enabling companies to quickly adapt to changing project requirements or market conditions by swapping equipment. This agility mitigates risks associated with project scope changes or sudden shifts in material specifications. The ability to access the latest technology without a long-term commitment is a significant advantage.

Ownership, while providing complete control over the asset, carries the risk of technological obsolescence. A purchased crusher is a fixed asset that may become less efficient or economically viable compared to newer models introduced to the market. This risk must be weighed against the potential benefits of asset depreciation and eventual resale value.

Equipment Selection Analysis Based on Throughput

Selecting the right mobile crusher is intrinsically linked to the project's throughput requirements. An incorrect match between equipment capacity and production goals can lead to severe inefficiencies, increased operational costs, and failure to meet deadlines. A thorough analysis of expected throughput guides the choice of crusher type and size, ensuring the selected machine can handle the anticipated volume of material effectively.

Calculating Throughput and Practical Variables

The theoretical throughput of a crusher is derived from its design specifications, such as the size of the feed opening and the power of its engine. However, actual throughput is influenced by numerous practical variables including material hardness, moisture content, and the efficiency of the feeding system. A conservative estimate that accounts for these factors is crucial for reliable planning.

Operators must consider the desired product gradation, as producing a finer discharge size typically reduces the machine's overall throughput. Therefore, the target product specification is just as important as the raw volume of material when determining the necessary crushing capacity.

Decision Making for Low Throughput Scenarios

For projects with consistently low throughput requirements, typically below 100 tons per hour, renting a compact mobile crusher is often the most economical path. Purchasing equipment for such small-scale operations risks creating an underutilized asset that incurs ownership costs long after the project concludes. Rental agreements provide access to precisely the capacity needed without long-term financial ties.

The operational simplicity of smaller crushers also aligns well with rental models, as they require less specialized knowledge to operate effectively. This makes them ideal for short-duration tasks like small demolition projects or landscaping work where crushing needs are intermittent.

Considerations for High Throughput Scenarios

Large-scale operations demanding throughputs exceeding 300 tons per hour present a different set of considerations. In these cases, purchasing a high-performance machine, such as a powerful cone crusher or a large jaw crusher, may prove more efficient and cost-effective over time. The high daily rental costs for such large equipment can quickly accumulate, making ownership a viable alternative.

However, the decision to purchase must be supported by confidence in the sustained demand for the crusher's output. If the high-throughput need is temporary, the financial burden of owning and maintaining a large, specialized machine could outweigh the benefits.

The Effect of Throughput Fluctuations

Many projects experience significant fluctuations in their daily or seasonal throughput requirements. For instance, a quarry may have periods of high production followed by slower phases. In such dynamic environments, the flexibility of renting becomes a major advantage.

Companies can scale their equipment up or down by adjusting rental terms, ensuring they only pay for the capacity they need at any given time. This pay-as-you-go model protects against the costs of owning machinery that sits idle during low-demand periods, optimizing overall expenditure.

In-depth Impact of Project Duration on the Decision

The length of a project is perhaps the most decisive factor in the rent-versus-buy equation. Short-term projects clearly benefit from the low commitment of rental, while long-term engagements can justify the capital outlay of purchase. The gray area lies in medium-duration projects, where a detailed total cost analysis is essential. Understanding how duration influences risk and control is key to making a sound investment.

The Rental Advantage for Short-Term Projects

Projects with a duration of less than six months are almost universally suited for rental. The primary benefit is the absence of a long-term asset commitment. Once the project is complete, the equipment is simply returned to the rental company, eliminating concerns about storage, maintenance during idle periods, or depreciation.

This model is ideal for defined tasks like road repair, small building constructions, or specific mining phases where the crushing need is temporary and clearly bounded. Rental contracts for such periods are straightforward and offer financial predictability.

Weighing Options for Medium-Term Projects

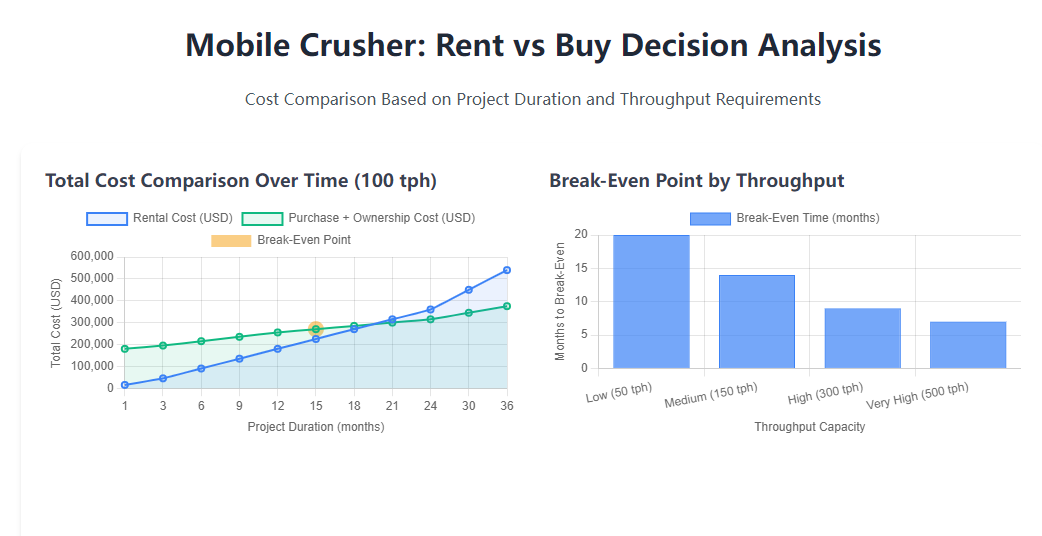

For projects lasting between six months and two years, the decision becomes more complex. A simple comparison of cumulative rental costs versus the purchase price is necessary. Often, the total rental fees over this period may approach or even exceed the initial purchase cost of a comparable machine.

However, the lower risk profile of renting often makes it the safer choice. If the project is canceled early or its scope is reduced, the financial repercussions of terminating a rental agreement are typically far less severe than being stuck with a specialized piece of equipment that is no longer needed.

The Rationale for Purchasing in Long-Term Projects

When a project extends beyond two years, purchasing a mobile crusher almost always becomes more economical from a total cost perspective. The sum of monthly rental payments over such an extended period will significantly surpass the depreciation and maintenance costs of owned equipment.

Furthermore, ownership provides the benefit of asset residual value. After the project concludes, the crusher can be deployed on another site, sold on the secondary market, or used as a trade-in for newer technology, providing a return on the initial investment.

Managing Project Extension Risks

Project delays are a common occurrence, and a sound decision must account for this possibility. Rental contracts should include clear terms for extensions, outlining any potential rate changes. For purchased equipment, a contingency budget for extended maintenance and operational costs should be part of the financial planning.

The ability to handle extensions smoothly is a mark of a robust decision. Renting offers a clear path for extending service, while ownership requires proactive management to ensure the equipment remains reliable for the extended duration.

Cost Comparison Model: Total Cost of Ownership for Rent vs. Buy

To make an objective decision, a detailed financial model comparing the total cost of ownership for both options is indispensable. This model must encompass all direct and indirect

expenses over the relevant time horizon, not just the most obvious upfront costs. A comprehensive analysis reveals the true economic impact of each choice.

Components of Purchase Cost

The total cost of purchasing a mobile crusher includes the initial invoice price, transportation to the site, and installation or setup fees. Beyond this, ongoing expenses such as preventive and corrective maintenance, insurance, storage, and parts inventory contribute to the lifetime cost. Depreciation, the reduction in the asset's value over time, is a significant non-cash expense that affects the company's balance sheet.

Calculating the lifecycle cost requires forecasting these expenses for the expected service life of the equipment. This provides a more accurate picture than simply considering the purchase price alone.

Structure of Rental Costs

Rental costs are typically structured as a fixed monthly payment, but they can include several ancillary charges. These may consist of a security deposit, delivery and pickup fees, and usage-based surcharges for exceeding agreed-upon operating hours or mileage. It is crucial to understand the full fee structure to avoid unexpected costs.

Comparing different rental proposals from various suppliers ensures that the company secures the most favorable terms. The transparency of rental costs makes budgeting straightforward, as expenses are directly tied to the usage period.

Application of Discounted Cash Flow Analysis

A Discounted Cash Flow (DCF) analysis is a powerful tool for comparing the financial outcomes of renting and buying. It converts all future cash flows—both inflows and outflows—into their present value, accounting for the time value of money. Rental payments represent a steady stream of outflows, while purchasing involves a large initial outflow followed by smaller, intermittent maintenance costs and a potential final inflow from the asset's sale.

By applying an appropriate discount rate, the DCF model can determine which option has the lower net present cost, providing a rigorous financial basis for the decision.

Estimating Residual Value and Asset Liquidation

The residual value of a purchased crusher at the end of a project is a critical variable in the cost model. This value depends on the machine's condition, brand reputation, hours of operation, and overall market demand for used equipment. An accurate estimate can significantly reduce the net cost of ownership.

However, the used equipment market can be volatile. A conservative estimate of residual value is prudent to avoid overstating the financial benefits of purchasing. The ability to quickly liquidate the asset is also a factor to consider.

Analysis of Flexibility and Strategic Factors

Beyond pure financial calculations, strategic considerations related to flexibility and long-term business positioning play a vital role. The ability to adapt to technological change, regulatory shifts, and evolving market demands can be as valuable as minimizing immediate costs. These factors influence the company's competitive edge and operational resilience.

Market Changes and Equipment Adaptability

Market conditions for construction materials or recycled aggregates can change rapidly. Renting provides the agility to switch to a different type of crusher, such as an impact crusher for better shape characteristics, if project requirements evolve. This adaptability is crucial for staying competitive.

In contrast, owning a crusher locks the company into a specific technology and capacity. Adapting to new market demands with owned equipment might require costly modifications or the difficult process of selling the old machine and purchasing a new one.

The Pace of Technological Updates

The technology behind mobile crushing equipment is continuously improving, with enhancements in fuel efficiency, automation, and emissions control. Rental companies frequently update their fleets, allowing tenants to benefit from the latest advancements without additional capital investment.

For a company that purchases equipment, there is a risk that its machine will become outdated within a few years, potentially making it less efficient or even non-compliant with future environmental regulations. This technological risk is a key strategic disadvantage of ownership.

Focusing on Core Business Capabilities

For companies whose primary business is not material processing, renting crushing equipment allows them to focus on their core competencies, such as general contracting or mining operations. The rental company handles the complexities of equipment maintenance, repair, and disposal.

Conversely, if crushing is a central and recurring part of the business, owning the equipment can provide greater control over operations, scheduling, and cost management. It can become a strategic asset that supports the company's long-term growth and specialization in areas like aggregate processing.

Regulatory and Environmental Requirements

Environmental regulations governing noise, dust, and emissions are becoming increasingly stringent worldwide. Rental agreements often include a guarantee that the equipment meets current standards, transferring the compliance burden to the rental provider.

Owners of crushers are directly responsible for ensuring their machines comply with all regulations. This may require investing in expensive upgrades or retrofits as laws change, adding an unpredictable cost and administrative burden to ownership.

Implementation Steps and Contract Considerations

Once the strategic decision to rent or buy has been made, successful implementation depends on careful planning and meticulous attention to contractual details. This phase involves assessing specific needs, selecting reliable partners, and negotiating terms that protect the company's interests throughout the project lifecycle.

Assessing Requirements and Gathering Data

The first step is a thorough assessment of project requirements, including accurate throughput estimates, material characteristics, project timeline, and site-specific conditions. This data is essential for selecting the right equipment model and negotiating favorable terms. Gathering specifications from multiple equipment manufacturers or rental companies provides a basis for comparison.

This due diligence phase prevents costly mistakes, such as ordering a crusher with insufficient capacity or one that is incompatible with the local power supply or access roads. Precise data is the foundation of a successful equipment acquisition strategy.

Selecting Suppliers and Negotiating Terms

Choosing a reputable supplier is critical, whether for rental or purchase. For rentals, factors include the size and quality of the fleet, responsiveness of service support, and transparency of pricing. For purchases, the manufacturer's reputation for reliability, availability of spare parts, and quality of after-sales service are paramount.

Negotiation should extend beyond price to include key terms like warranty coverage, service level agreements for repairs, and flexibility in contract duration. A well-negotiated contract provides security and defines the responsibilities of each party clearly.

Key Clauses in Rental Contracts

A rental contract must be scrutinized for several critical clauses. These include the rental period, options for extension or early termination, clear delineation of maintenance and repair responsibilities, liability for damage, and any hidden fees. Understanding who is responsible for routine wear and tear versus major breakdowns is essential to avoid disputes.

The contract should also specify delivery and pickup schedules, performance guarantees for the equipment, and procedures for reporting operational issues. A comprehensive contract minimizes operational risks during the project.

Purchase Agreements and After-Sales Service

A purchase agreement for a mobile crusher should include detailed specifications, delivery terms, warranty conditions, and a clear outline of after-sales support. This support often includes operator training, initial setup assistance, and access to technical documentation. Ensuring a reliable supply of wear parts like mantles and liners is crucial for uninterrupted operation.

The warranty period and what it covers can significantly impact the total cost of ownership. A strong after-sales service network, especially for companies operating in remote mining and quarrying locations, is an invaluable aspect of the purchase decision.