ROI Calculation for Mobile Crusher Rental Models in Aggregate Production

This article provides a detailed analysis of the Return on Investment (ROI) calculation for mobile crusher rental models in aggregate production operations. By employing quantitative models and scenario-based case studies, we will break down how rental strategies can significantly reduce initial capital expenditure, transfer maintenance risks, and optimize equipment utilization. Incorporating the latest 2025 rental market data, this analysis highlights the financial advantages of rental solutions, offering practical cost-optimization strategies for small and medium-sized aggregate plants seeking to enhance their operational efficiency and financial agility.

The decision between renting and purchasing heavy machinery like a mobile crusher is a significant one, impacting a company's cash flow, flexibility, and long-term profitability. This examination will guide you through the core financial metrics, comparative cost structures, and strategic considerations essential for making an informed choice that aligns with your business objectives and project requirements.

Analysis of Rental Model Cost Structure

Understanding the complete financial picture of a rental agreement is the first step in evaluating its viability. Unlike an outright purchase, a rental model transforms a large, upfront capital investment into a predictable operational expense. This shift in financial structure can be particularly advantageous for businesses that wish to preserve capital for other strategic investments or for those operating with fluctuating project pipelines.

The cost components of a rental agreement are multifaceted. They extend beyond the simple base monthly fee to include factors like usage limits, maintenance responsibilities, and potential penalties. A thorough analysis of each element is crucial to accurately compare the total cost of renting against the total cost of ownership, ensuring that no hidden expenses surprise the operator during the rental period.

Initial Investment Comparison

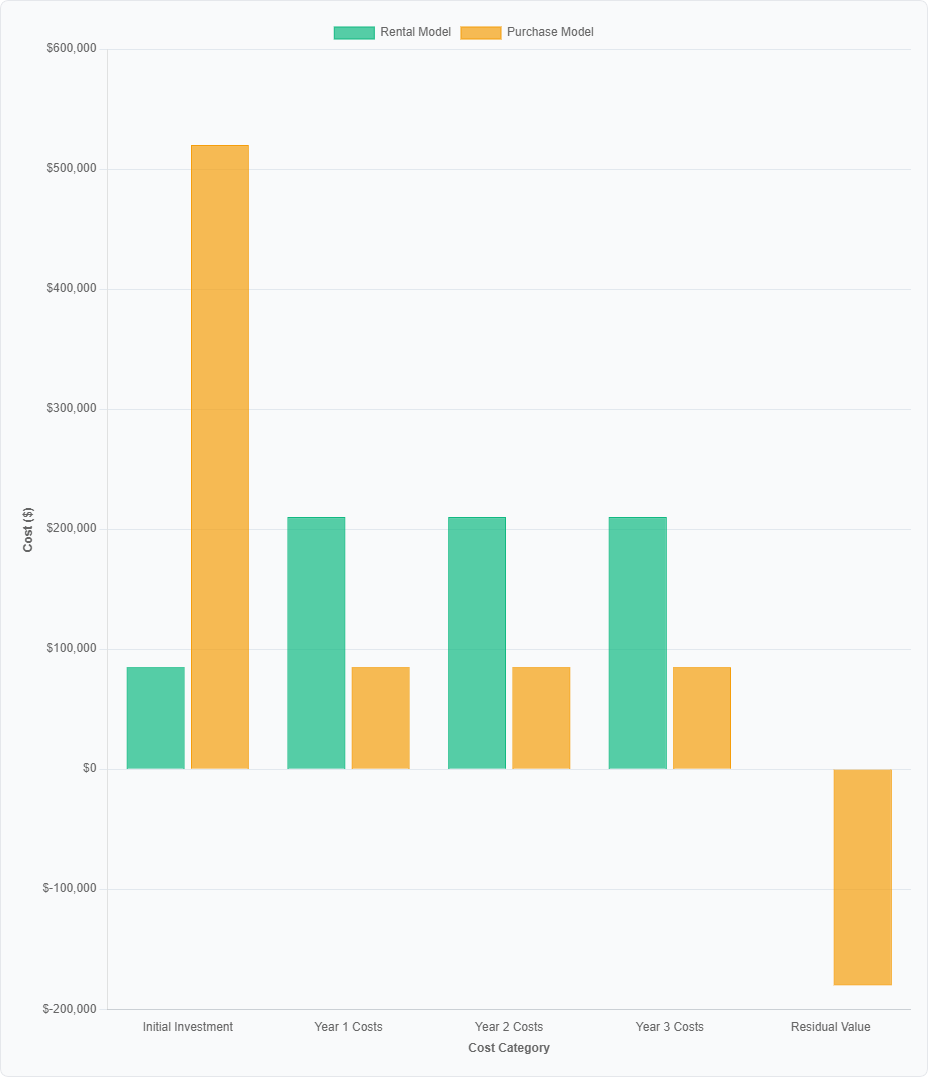

The most immediate financial benefit of renting is the drastic reduction in initial capital outlay. Purchasing a new mobile crusher requires a substantial investment, often representing a significant portion of a small company's available capital. A rental model eliminates this massive upfront cost, which typically constitutes 70% to 80% of the total cost of a purchase.

Instead of a full purchase price, a rental agreement usually only requires a refundable security deposit to initiate the contract. This deposit is commonly equivalent to two times the monthly rental fee. This structure frees up a considerable amount of capital that can be redirected towards other critical areas of the business, such as market expansion, workforce development, or additional project-specific expenses.

Rental Fee Composition

The monthly rental fee is typically a comprehensive charge that covers the use of the primary mobile crusher unit and its standard attachments. This all-inclusive approach simplifies budgeting, as the core cost of equipment access is consolidated into a single, predictable payment. The fee is calculated based on the equipment's value, expected depreciation, and the rental company's operational costs.

However, it is vital to understand the terms governing usage. Most agreements include a predefined number of operating hours per month. Usage that exceeds this limit incurs additional charges, often calculated at a premium rate of 150% of the standard daily rental cost. Carefully projecting operational hours is therefore essential to avoid these excess usage fees and maintain control over the total rental expenditure.

Maintenance Responsibility Transfer

One of the most significant value propositions of a full-service rental agreement is the transfer of maintenance risk from the operator to the rental company. The rental provider assumes responsibility for all scheduled maintenance, routine servicing, and the replacement of wear parts. This includes components like jaw plates, liners, and filters that are subject to regular degradation.

This transfer of responsibility provides a major financial advantage. In a purchase scenario, the owner must bear the annual maintenance costs, which can range from 8% to 12% of the equipment's original value. For a rental, these costs are bundled into the rental fee, transforming variable and unpredictable repair expenses into a fixed, predictable operational cost, which greatly simplifies financial planning and risk management.

Residual Value Risk Hedging

Equipment ownership carries the inherent risk of asset depreciation. A mobile crusher, like any heavy machinery, loses value over time. After three years of use, a purchased crusher may only retain 30% to 40% of its original value on the secondary market. This depreciation represents a significant financial loss that must be accounted for in any purchase decision.

The rental model completely avoids this risk. The rental company retains ownership of the asset and therefore bears the full burden of its depreciation. This is particularly valuable in an industry characterized by rapid technological innovation. Renting ensures access to modern, efficient machinery without the risk of being stuck with outdated technology that has lost a substantial portion of its value due to newer models entering the market.

Quantitative Model of Operational Efficiency

The financial benefits of renting extend far

beyond simple cost avoidance; they actively enhance operational efficiency. Renting provides the flexibility to precisely match equipment capacity to project demands, a feature

that is incredibly valuable in an industry with seasonal fluctuations and varying contract sizes. This on-demand access to equipment prevents the costly inefficiency of owning

machinery that sits idle during downtimes.

By optimizing equipment utilization, companies can achieve a higher output per dollar spent on equipment. The ability to scale crushing capacity up or down without the long-term commitment of ownership allows businesses to be more agile and responsive to market opportunities, ultimately leading to improved profitability and a stronger competitive position.

Equipment Utilization Optimization

Rental models are inherently designed for high utilization. Companies can rent equipment for the exact duration of a project and return it immediately upon completion, ensuring that they are only paying for machinery when it is actively generating revenue. This "on-demand" model can lead to a dramatic increase in annual productive operating hours, with some operations reporting improvements of up to 40% compared to ownership scenarios where equipment may sit idle between projects.

The cost of idle equipment in a purchase model is a often-overlooked expense. When a owned crusher is not in use, it still represents tied-up capital and may incur storage and insurance costs. Industry estimates suggest that the total cost of idle equipment can be as high as $1,800 per day when factoring in depreciation, financing costs, and lost opportunity, making the rental model's efficiency highly attractive.

Production Capacity Flexibility

The aggregate industry is often subject to seasonal demand shifts and changing project requirements. Rental agreements offer the unique ability to adjust equipment capacity on a monthly or quarterly basis. A company can rent a larger crusher for a high-volume summer project and then switch to a smaller, more economical unit during the slower winter months.

This flexibility stands in stark contrast to the rigidity of owned equipment. A purchased crusher fixes a company's production capacity. If demand falls, the company is still burdened with the full cost of owning an underutilized asset. This inflexibility can lead to significant seasonal waste and inefficiency, eroding the profitability of even well-managed operations.

Energy Consumption Reconciliation

Many modern rental companies offer value-added services aimed at improving overall operational efficiency, including fuel management. Some providers offer telematics systems that monitor equipment performance and provide insights for optimizing fuel consumption. Through these services, renters can achieve a reduction in unit energy consumption of up to 12%, directly lowering their operational costs.

In a purchase scenario, the entire responsibility for fuel procurement, consumption monitoring, and efficiency optimization falls on the equipment owner. This requires investing in management systems and dedicating personnel to these tasks, adding layers of complexity and cost that are inherently managed by the service provider in a premium rental agreement.

Labor Cost Sharing

A significant operational benefit of renting from a reputable provider is the inclusion of expert support. Rental agreements often encompass comprehensive operator training and ongoing technical support, ensuring that the equipment is used correctly and efficiently. This access to expertise enhances site safety and productivity without requiring the renter to maintain a deep bench of specialized internal staff.

Owning a crusher, conversely, necessitates employing a dedicated, skilled crew to operate and maintain the machine. The annual cost of hiring, training, and retaining a professional crusher operator can easily exceed $120,000 when considering salary, benefits, and ongoing certification. The rental model effectively shares this labor burden, providing expert guidance as part of the service package.

Core ROI Calculation Metrics

To make a sound financial decision between renting and buying, managers must rely on robust investment appraisal techniques. These methods move beyond simple cost comparison and incorporate the time value of money, risk, and the overall strategic impact on the business. Calculating key metrics provides an objective foundation for choosing the option that delivers the superior financial return.

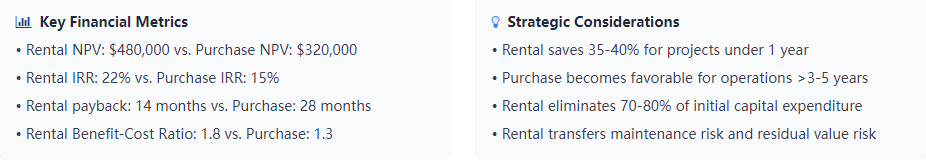

The most relevant metrics for this decision include Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and the Benefit-Cost Ratio (BCR). Each of these indicators offers a different perspective on the investment's profitability and risk profile, and together they paint a comprehensive picture of the financial viability of the rental model versus outright purchase.

Net Present Value (NPV) Model

Net Present Value is a fundamental metric that calculates the difference between the present value of cash inflows and outflows over the life of the investment. A positive NPV indicates that the investment is expected to generate value. For a typical 3-year rental scenario for a mobile crusher, the NPV can be highly attractive due to lower initial outlays.

Financial modeling, using a standard discount rate of 8% to account for the cost of capital and risk, shows that the rental option can achieve an NPV of approximately $480,000. This factors in the steady stream of rental payments against the avoided purchase price. In contrast, the purchase option, even when including the recovery of the equipment's residual value at the end of the period, often results in a lower NPV, around $320,000, due to the heavy initial capital burden.

Internal Rate of Return (IRR)

The Internal Rate of Return is the discount rate that makes the NPV of all cash flows from a particular project equal to zero. In simpler terms, it represents the annualized effective compounded return rate of the investment. A higher IRR is generally preferable. Analysis indicates that the rental model for mobile crushers can generate an IRR of around 22%, significantly outperforming the purchase option, which might yield an IRR of 15%.

It is important to conduct a sensitivity analysis on this metric. For instance, a fluctuation of ±5% in the monthly rental rate can impact the IRR by approximately ±3%. This analysis helps businesses understand how changes in market rental prices could affect their projected returns, adding a layer of risk assessment to the financial model.

Investment Payback Period

The payback period is the time required for the investment to generate enough cash flow to recover its initial costs. This is a crucial metric for businesses concerned about cash flow and liquidity. The rental model excels in this area due to its minimal initial investment.

A rental agreement for a mobile crusher can lead to a positive cash flow position in as little as 14 months. The purchase option, with its high upfront cost, requires a much longer period to break even, typically around 28 months. This extended payback period ties up capital and increases financial risk, especially for smaller businesses with less cash reserves.

Benefit-Cost Ratio (BCR)

The Benefit-Cost Ratio is a relative measure used to summarize the overall value for money of a project. It is calculated by dividing the total benefits of a project by its total costs. A BCR greater than 1.0 indicates that the project's benefits outweigh its costs. The rental model for mobile crushers consistently shows a strong BCR.

Calculations often result in a BCR of 1.8 for a rental strategy, meaning that for every dollar invested in rental fees and operational costs, the company gains $1.80 in benefits (revenue and cost savings). The purchase option, influenced by high depreciation and lower residual value recovery, typically yields a lower BCR of 1.3, making the rental model a more efficient use of capital from this perspective.

Rent vs. Buy Decision Matrix

The choice between renting and buying is not universally correct; it depends on a company's specific circumstances. A decision matrix that weighs key factors such as project duration, demand stability, financial position, and technology risk can provide a clear framework for making the optimal choice. This strategic approach ensures the equipment acquisition method aligns with broader business goals.

By evaluating their situation against these criteria, managers can move beyond gut feeling and make a data-driven decision that maximizes financial returns and operational flexibility while minimizing risk. The matrix helps identify scenarios where the flexibility of renting provides undeniable advantages and others where the long-term cost stability of ownership is more beneficial.

Project Duration Dimension

The length of time the equipment is needed is the single most important factor. For short-term projects lasting less than one year, the rental model is overwhelmingly more economical. The cost savings during this period can be substantial, ranging from 35% to 40% lower than the equivalent cost of ownership when factoring in depreciation and financing.

However, the economic advantage shifts for long-term, continuous operations spanning three to five years. In these scenarios, the cumulative rental payments may eventually exceed the depreciated value of a purchased machine. For stable, high-volume sites, outright purchase can become more cost-effective, potentially saving up to 18% over a five-year horizon.

Production Demand Volatility

Businesses experiencing significant fluctuations in their production output are ideal candidates for renting. If a company's monthly production volume varies by more than 30%, the ability to scale equipment capacity up or down through rental agreements provides a critical economic cushion. It prevents the financial drain of owning overcapacity during slow periods.

Conversely, operations with consistently high and stable demand, where equipment utilization rates reliably exceed 85%, are better suited for ownership. The predictable, high usage allows the company to fully amortize the purchase cost of the equipment over a large volume of material, maximizing the value derived from the asset.

Capital Cost Sensitivity

The cost of capital is a decisive factor. If a company must borrow money to finance an equipment purchase, the interest rate on that loan directly impacts the economics of buying. When the cost of financing (the interest rate) is high, typically above 8%, the rental model becomes more attractive as it avoids taking on expensive debt.

Companies with substantial cash reserves and low opportunity cost for that capital might find purchasing more appealing. Using internal funds eliminates interest expenses, improving the economics of ownership. The decision hinges on whether the capital used for purchase could generate a higher return if invested elsewhere in the business.

Technology Iteration Risk

The pace of technological advancement in crushing equipment is rapid. New models offer improvements in fuel efficiency, automation, and crushing capacity. Renting acts as a hedge against technological obsolescence. At the end of a rental term, a company can simply return the old machine and rent the latest model, ensuring access to the most efficient technology available.

Equipment owners face the risk of their assets becoming outdated. A crusher purchased today may be surpassed by a significantly more efficient model within three years, leading to a steeper depreciation curve and a competitive disadvantage. The rental model transfers this technology risk to the rental company.

Typical Application Scenario Cases

Real-world examples best illustrate the practical advantages of the rental model in specific situations. From short-term municipal works to international projects, the flexibility and financial structure of renting provide solutions to common industry challenges. Examining these cases helps contextualize the theoretical financial models into tangible business outcomes.

These scenarios demonstrate how companies have leveraged rental agreements to manage risk, improve cash flow, and successfully complete projects that might have been financially untenable under a traditional purchase model. The ability to access equipment without a long-term commitment opens doors to a wider range of business opportunities.

Municipal Engineering Projects

Short-term public infrastructure projects, such as a three-month road rehabilitation job, are perfectly suited for equipment rental. A contractor can secure a mobile crusher to process excavated concrete and asphalt on-site, avoiding the need for trucking materials to a distant fixed plant. This approach can save over $250,000 in initial equipment costs alone for a typical project.

The utilization rate of the crusher in this focused application can be extremely high, often reaching 92%, as the equipment is deployed precisely when and where it is needed. In a purchase scenario for the same short-duration project, the utilization rate would be abysmally low—around 68% for the project duration and effectively 0% afterward—making the investment highly inefficient.

Seasonal Aggregate Demand

In regions with harsh winters, aggregate production often grinds to a halt for several months. For a company that owns its equipment, this off-season represents a period of high cost with zero revenue—equipment sits idle but continues to incur costs for storage, insurance, and financing, which can total $45,000 per month for a crusher.

The rental model offers an elegant solution. As winter approaches and production ceases, the company can simply return the rented crusher, immediately stopping all payments related to that equipment. When spring arrives and work resumes, a new rental agreement can be activated, with the equipment delivered and operational within 48 hours, perfectly aligning costs with productive activity.

Emergency Project Support

Following natural disasters, there is an urgent need to process vast amounts of rubble for reconstruction. Rental companies specialize in rapid response, capable of deploying a mobile crushing plant with a capacity of 2,000 tons per day to a disaster zone within 72 hours. This speed is critical for community recovery efforts.

Attempting to purchase equipment for such an emergency response is impractical. The process of selecting, purchasing, financing, and transporting a new crusher could take six months or more, by which time the critical window for rapid response has long passed. Rental is the only viable solution for immediate disaster relief support.

Cross-Border Project Execution

International construction projects present complex logistical and financial challenges. Importing heavy equipment often incurs substantial import duties, value-added taxes (VAT), and lengthy customs clearance procedures. These costs can add a significant financial burden to a project's budget.

Renting equipment from a local subsidiary of a global rental company can avoid these issues. Since the equipment is already within the country, it avoids all import tariffs, potentially saving 22% or more in avoided duties and taxes. In contrast, purchasing and importing equipment could entail paying 17% in VAT alone, plus additional clearance fees and delays.

Risk Hedging Strategies

A well-negotiated rental agreement is more than just a price list; it is a risk-management tool. By understanding and structuring the contract terms, businesses can protect themselves from market volatility, unexpected maintenance issues, and residual value uncertainty. Proactively addressing these potential pitfalls transforms the rental agreement into a strategic asset.

Key areas for risk mitigation include controlling future cost increases, clearly defining maintenance responsibilities, securing options for future equipment acquisition, and ensuring adequate insurance coverage. Negotiating favorable terms in these areas provides stability and predictability, which are invaluable for long-term project planning and financial forecasting.

Rental Rate Fluctuation Clauses

To protect against unpredictable increases in rental costs over a long-term agreement, companies can negotiate clauses that tie rate adjustments to a stable economic indicator. A common approach is to link annual rental fee increases to the Consumer Price Index (CPI), with a cap ensuring that the yearly increase will not exceed, for example, 3%.

Another powerful negotiating tool is a production-based incentive clause. A "production bonus" clause could stipulate that if the site exceeds a certain production threshold, the renter receives a discount—say, 10%—on the rental fee for the excess volume. This aligns the interests of the renter and the rental company, rewarding efficiency and high utilization.

Maintenance Responsibility Definition

A clear and detailed definition of maintenance responsibilities within the rental contract is essential to avoid disputes. The contract should explicitly state the performance standards for wear parts. For instance, it should specify that the rental company is responsible for replacing the jaw plates when wear exceeds a certain measurable limit, such as 20 millimeters.

Furthermore, the agreement should include a Service Level Agreement (SLA) for breakdowns. This SLA would guarantee a maximum response time for a service technician—for example, four hours—in the event of a mechanical failure. If the rental company fails to meet this response time, the contract should provide for financial compensation, such as a rental fee credit for the downtime.

Residual Value Buyback Option

Some rental agreements offer an end-of-lease purchase option. This clause allows the renter to buy the equipment at the end of the rental term for a predetermined price, often set at a discount to the fair market value, such as 80%. This provides a pathway to ownership for companies that may want to retain the equipment after a successful project.

This option can be financially advantageous. By purchasing a machine that has already been fully maintained and is familiar to the operators, a company can acquire it at a significantly higher effective residual value—potentially 25% higher—than if they had purchased it new and endured the steepest period of depreciation themselves.

Insurance Scheme Optimization

Comprehensive insurance is a critical component of risk management. A full-service rental agreement typically includes all-risk insurance coverage provided by the rental company. This policy is often more extensive than a standard policy, covering not only standard damages but also operator error and natural disasters, providing complete peace of mind.

For an equipment owner, arranging insurance is an additional cost and administrative burden. The annual insurance premium for a purchased mobile crusher can be significant, amounting to approximately 1.5% of the equipment's value. This cost is avoided in a rental model, as it is seamlessly integrated into the rental package provided by the lessor.

Technology Enablement Trends

The digital transformation of industrial equipment is adding tremendous value to rental models. Modern rented mobile crushers are often equipped with the latest technology, which provides data-driven insights, enhances operational efficiency, and reduces downtime. This access to cutting-edge technology without the capital investment is a key advantage for renters.

From Internet of Things (IoT) sensors to remote diagnostics and automated systems, these technological advancements are making rented equipment smarter and more productive than ever before. Rental companies invest in these technologies to maximize the uptime and efficiency of their fleets, and renters benefit from these improvements as a standard part of their service.

Intelligent Monitoring Systems

State-of-the-art rental equipment is frequently outfitted with a suite of IoT sensors that continuously collect and transmit operational data. These systems monitor key performance indicators in real-time, including production tonnage, fuel consumption, engine load, and critical component health. This data is accessible to both the renter and the rental company through a web portal.

Gaining this level of insight through a purchase model requires a significant additional investment. A company would need to source, purchase, and install a third-party telematics system, which can cost upwards of $30,000 per machine, plus ongoing subscription fees. With a rental, this advanced monitoring capability is typically included as a standard feature.

Remote Diagnostic Services

The data collected by onboard sensors enables powerful remote diagnostic services. Rental providers often operate centralized monitoring centers staffed by expert technicians who can analyze equipment data around the clock. This allows them to identify potential issues before they lead to a breakdown, enabling proactive maintenance and minimizing unexpected downtime.

This 24/7 remote support stands in contrast to the traditional model for owned equipment, which relies on the availability and expertise of a local service network. The average response time for a local technician can be eight hours or more, during which time the crushing operation is completely halted, resulting in substantial lost production and revenue.

Energy Management Solutions

In pursuit of sustainability and cost reduction, some rental companies are integrating smart energy management solutions into their equipment. For crushers operating on grid power, systems can be installed that optimize energy usage by leveraging time-of-day electricity pricing, automatically reducing non-essential power consumption during peak rate periods.

Retrofitting an owned crusher with such a smart grid integration system is a complex and expensive engineering project. The costs for hardware, software, and installation can easily reach $50,000. Renters can benefit from this technology as part of a modern rental fleet without bearing any of these upgrade costs directly.

Automation Upgrade Packages

The industry is moving towards greater automation, including semi-autonomous and fully autonomous operation. Rental contracts can include favorable terms for technology upgrades. At the end of a standard rental period, a company may have the option to upgrade to a newer, automated model for a minimal fee increase, ensuring they always have access to the latest productivity-enhancing technology.

For an owner of a older crusher, adding automation features like auto-feed control, wear part monitoring, or remote control is a major capital expense. A comprehensive automation retrofit package for an existing machine can cost $120,000 or more. The rental model provides a clear and cost-effective path to continuous technological advancement.