Selection Trade-Offs Between Gyratory Crushers and Jaw Crushers in Large-Scale Primary Crushing

In large-scale primary crushing—used extensively in mining and quarrying, aggregate processing, and C&D waste recycling—choosing between gyratory crushers and jaw crushers is a decision that shapes operational efficiency, long-term costs, and product quality. Both machines reduce large, hard materials (such as granite, basalt, or iron ore) into smaller particles for downstream processes, but they differ sharply in design, performance, and suitability for specific tasks. This page breaks down the key trade-offs in their selection, covering core performance parameter comparisons, structured decision model construction, real-world industry application cases, emerging technological trends, maintenance optimization strategies, and policy compliance requirements. By combining practical data and clear analysis, it helps readers—from plant operators to engineering planners—match the right crusher to their project’s scale, material type, and operational goals.

Core Performance Parameter Comparative Analysis

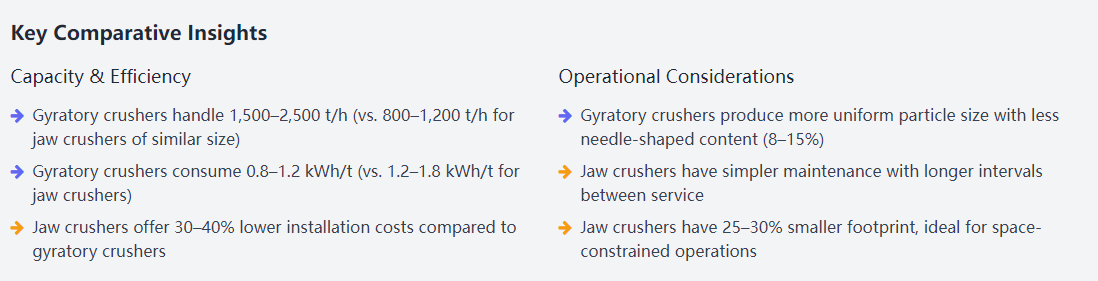

To choose between gyratory and jaw crushers, understanding their core performance parameters is essential—these metrics directly determine how well each machine handles large-scale primary crushing demands. Parameters like processing capacity, energy efficiency, discharge particle quality, space requirements, and maintenance needs vary significantly, and prioritizing one metric (e.g., high throughput vs. low initial cost) will guide the selection. For example, gyratory crushers often outperform jaw crushers in capacity and efficiency, while jaw crushers excel in simplicity and space savings. This section compares each key parameter with real-world data, highlighting strengths and limitations to inform objective decision-making.

Processing Capacity and Energy Efficiency Differences

Processing capacity—measured in tons per hour (t/h)—is critical for large-scale operations, where maximizing throughput directly boosts productivity. Gyratory crushers deliver substantially higher capacity than jaw crushers of similar size. A large gyratory crusher with a feed opening of 1200 x 1500 mm can process 1,500–2,500 t/h of hard rock (e.g., granite or iron ore), while a jaw crusher with the same feed opening typically handles 800–1,200 t/h. This gap stems from the gyratory crusher’s continuous crushing action: its rotating movable cone applies steady pressure to material, eliminating the intermittent gaps in processing that occur with a jaw crusher’s reciprocating “jaw” motion. In mining operations processing over 2,000 t/h, this means a single gyratory crusher can replace two or three jaw crushers, simplifying workflow and reducing equipment coordination needs.

Energy efficiency—measured in kilowatt-hours per ton (kWh/t)—directly impacts operational costs, especially for sites running 24/7. Gyratory crushers are more energy-efficient, consuming 0.8–1.2 kWh/t for hard rock crushing, compared to 1.2–1.8 kWh/t for jaw crushers of similar capacity. This efficiency advantage comes from the gyratory crusher’s optimized crushing chamber design, which distributes force evenly across material to minimize energy waste. For example, a mine processing 1.8 million tons annually would save 360,000–720,000 kWh per year with a gyratory crusher instead of a jaw crusher—equivalent to reducing energy costs by $40,000–$80,000 annually (based on average industrial energy prices). However, for smaller operations (processing<500 t/h), the efficiency gap narrows: a small jaw crusher may consume 1.3 kWh/t, only slightly more than a small gyratory crusher’s 1.1 kWh/t, making the jaw crusher more cost-competitive due to its lower initial price.

Discharge Size Uniformity and Needle-Shaped Particle Content Control

Discharge size uniformity—how consistent the crushed material’s particle size is—affects downstream processes like screening and concrete production. Gyratory crushers produce more uniform discharge size because their cylindrical crushing chamber and continuous compression action ensure even material breakdown. Industry tests show gyratory crushers have a particle size variation (ratio of 80% passing size to 20% passing size) of 1.5–2.0, compared to 2.0–2.5 for jaw crushers. This uniformity reduces the need for recirculating oversize or undersize particles to the crusher, cutting screening workload by 20–30%. For aggregate producers supplying concrete, this is critical: uniform particles improve concrete mix consistency, reducing strength variability by 15–20% and meeting stricter quality standards.

Needle-shaped (or flaky) particles—those with a length-to-thickness ratio >3:1—weaken concrete and asphalt, so controlling their content is key for high-spec applications. Jaw crushers generate more needle-shaped particles (15–25% for hard rock) because their shear-based crushing action can split material into elongated pieces. Gyratory crushers, by contrast, use compression to break material, limiting needle-shaped content to 8–15%. For highway asphalt production, where needle-shaped particles must stay below 10%, a gyratory crusher eliminates the need for additional shaping equipment (like a VSI crusher), saving $150,000–$300,000 in capital costs. For less demanding uses (e.g., construction fill), jaw crushers’ higher needle-shaped content is acceptable, allowing operators to prioritize lower upfront investment over particle shape.

Equipment Footprint and Installation Cost Comparison

Equipment footprint—the space needed for installation—is a major factor for space-constrained sites (e.g., urban recycling plants or underground mines). Jaw crushers have a more compact design: a large jaw crusher (1200 x 1500 mm feed opening) requires a footprint of ~20 x 15 meters (including feed hoppers and conveyors), while a gyratory crusher of the same capacity needs ~25 x 20 meters. This 25–30% smaller footprint makes jaw crushers ideal for urban C&D waste recycling plants, where land costs are high and expansion space is limited. For example, a city-center recycling facility with a 300-square-meter processing area can fit a jaw crusher but not a gyratory crusher of similar capacity.

Installation costs follow a similar pattern: jaw crushers are simpler to install, costing 30–40% less than gyratory crushers. A large jaw crusher installation (including foundation, electrical, and conveyor integration) typically costs $500,000–$700,000, while a gyratory crusher installation costs $800,000–$1.2 million. However, for very large operations (processing >2,000 t/h), gyratory crushers can offset this cost: one gyratory crusher replaces two jaw crushers, reducing total installation costs by 10–15% (since two jaw crusher installations would cost $1–1.4 million). Additionally, gyratory crushers require fewer feed adjustments, lowering the cost of automated feed systems by $20,000–$30,000 compared to jaw crusher setups.

Maintenance Cycle and Operational Cost Evaluation

Maintenance cycles determine equipment uptime—critical for large-scale operations where downtime can cost $10,000–$50,000 per day. Jaw crushers have simpler designs with fewer moving parts, leading to longer maintenance intervals. Key wear parts like movable jaw plates last 3–6 months in hard rock applications, and replacing them takes 8–12 hours with a small team. Gyratory crushers, by contrast, have complex components like the main shaft and movable cone, requiring inspections every 1–2 months and 24–36 hours for major part replacements. This leads to more downtime for gyratory crushers (5–8 days/year) vs. jaw crushers (3–5 days/year) in similar applications.

Operational costs—including labor, parts, and energy—also differ. Gyratory crushers have higher parts costs: a set of wear liners costs $20,000–$30,000, compared to $8,000–$15,000 for jaw crushers. They also need specialized maintenance technicians, increasing labor costs by 15–20%. However, in high-capacity operations, gyratory crushers’ higher throughput offsets these costs: a site processing 2,000 t/h spends $0.80–$1.00 per ton on operations with a gyratory crusher, vs. $1.00–$1.20 per ton with two jaw crushers. For smaller sites (processing<800 t/h), jaw crushers are more economical: their lower maintenance and labor costs bring operational costs to $0.90–$1.10 per ton, vs. $1.00–$1.30 per ton for a small gyratory crusher.

Applicable Material Types and Hardness Range Analysis

Material hardness—measured by compressive strength (MPa) or Mohs scale—dictates crusher suitability. Jaw crushers are versatile, handling materials from soft limestone (Mohs 3, 50–100 MPa) to hard granite (Mohs 7, 150–250 MPa). Their robust design tolerates abrasiveness and occasional contaminants (e.g., metal in C&D waste) because the toggle plate breaks under excessive load, protecting the main structure. This makes them ideal for recycling wet or contaminated materials, where clogging or damage risks are high.

Gyratory crushers excel in very hard, abrasive materials like basalt (Mohs 8, 250–300 MPa) or iron ore (Mohs 6–7, 200–280 MPa). Their continuous crushing action distributes wear evenly, extending liner life to 5–6 months in iron ore mining, vs. 2–3 months for jaw crushers. However, gyratory crushers struggle with high-moisture ( >15%) or clay-rich materials: wet material adheres to the rotating cone, causing clogging and 10–15% capacity loss. For example, a limestone quarry in a humid region processing 1,000 t/h of wet limestone (20% moisture) would see 95% uptime with a jaw crusher, vs. 80–85% uptime with a gyratory crusher. This makes jaw crushers better for humid climates or materials with high moisture content.

Selection Decision Model Construction

A structured selection decision model turns subjective preferences into objective choices by quantifying key factors like costs, capacity needs, and material properties. This model ensures alignment with short-term project goals (e.g., meeting production deadlines) and long-term sustainability (e.g., minimizing lifecycle costs). Without a model, operators may prioritize initial cost over efficiency, leading to higher expenses later. This section outlines how to build such a model, from calculating ROI and lifecycle costs to adapting to special Working conditions and leveraging smart tools—creating a repeatable framework for consistent, data-driven crusher selection.

Return on Investment (ROI) and Total Lifecycle Cost Calculation

ROI and Total Lifecycle Cost (TLC) are critical financial metrics that go beyond initial purchase price. ROI measures how quickly the crusher generates profit relative to investment: a gyratory crusher may have a $2–3 million initial cost (vs. $1–1.5 million for a jaw crusher of similar capacity) but delivers higher throughput, leading to faster ROI in large operations. Industry data shows gyratory crushers achieve ROI in 3–4 years for sites processing 2,000 t/h of hard rock, vs. 4–5 years for jaw crushers, due to $500,000–$1 million in additional annual revenue from higher throughput.

TLC includes all costs over the crusher’s 10–15-year lifespan: initial purchase/installation, energy, maintenance, parts, and labor. A large gyratory crusher’s TLC is $5–7 million (including $2.5 million initial costs, $1.5 million energy, $2 million maintenance), while a jaw crusher’s TLC is $4–6 million. However, if two jaw crushers are needed to match the gyratory’s capacity, their combined TLC rises to $6–8 million, making the gyratory more cost-effective. Key variables include local energy prices (e.g., $0.10/kWh vs. $0.15/kWh) and material hardness (e.g., 200 MPa vs. 300 MPa, which affects maintenance costs). For example, in a region with high energy prices ($0.15/kWh), a gyratory crusher’s energy savings add up to $120,000/year, reducing TLC by $1.2 million over 10 years.

Selection Standards for Different Scale Projects

Project scale—defined by annual processing volume—dictates crusher suitability. Small-scale projects (<500,000 tons/year, <500 t/h) benefit from jaw crushers. Their $1 million initial cost, simple installation (4–6 weeks), and low maintenance needs fit limited budgets and intermittent demand. For example, a small limestone quarry processing 200,000 tons/year (300 t/h) would overspend with a $1.8 million gyratory crusher, which requires specialized maintenance and longer installation (8–10 weeks).

Equipment Adaptation Cases Under Special Working Conditions

Special working conditions—like underground mines or high-moisture environments—require tailored crusher choices. Underground mines, with narrow tunnels (3–4 meters wide) and limited ventilation, prefer jaw crushers. Their compact design fits in tight spaces, and lower heat generation reduces cooling system costs by $30,000–$50,000/year. A gyratory crusher would need a 5-meter-wide tunnel, which is often unfeasible in existing mines.

High-moisture environments (material moisture >15%) favor jaw crushers. Their reciprocating motion breaks up sticky material, preventing clogging. A C&D waste recycling plant processing wet concrete debris (20% moisture) with a jaw crusher sees 95% uptime, vs. 80% uptime with a gyratory crusher (which clogs and needs frequent cleaning). Extreme-temperature environments ( < -20°C or >40°C) also benefit from jaw crushers: their simpler mechanical systems are less prone to freezing or overheating than gyratory crushers’ complex rotating components. For example, a mine in a cold region using a jaw crusher reduces winter downtime by 3–4 days/year compared to a gyratory crusher.

User Demand-Oriented Customized Solutions

Customized solutions address unique user needs, such as specific discharge sizes or mobility requirements. For example, an aggregate producer needing a 50–100 mm discharge size for road base may customize a jaw crusher with an adjustable adjustment device, allowing quick size changes (1–2 hours vs. 4–6 hours for a standard model). This customization costs $20,000–$30,000 but saves $50,000–$100,000/year in downtime.

For mobile crushing operations (e.g., on-site C&D waste recycling), customized mobile jaw crushers are preferred. They integrate a jaw crusher with a conveyor and screen on a tracked chassis, allowing on-site processing and reducing material transport costs by $5–10/ton. A customized mobile gyratory crusher is rare due to its size and weight, making it impractical for on-site use. Another customization is dust control systems: a quarry in a residential area may add a spray system to a jaw crusher, reducing dust emissions by 80% and meeting local air quality standards—critical for avoiding fines of $10,000–$20,000.

Intelligent Selection Recommendation System Development and Application

Intelligent selection systems use AI and machine learning to analyze project data (material type, capacity, budget) and recommend the best crusher. These systems integrate databases of 100+ crusher models and 1,000+ real-world cases, ensuring data-driven recommendations. For example, inputting “2,000 t/h, iron ore (280 MPa), $3 million budget” would trigger the system to recommend a gyratory crusher, citing ROI of 3.5 years and TLC of $6 million—vs. two jaw crushers with ROI of 4.5 years and TLC of $7 million.

These systems also adapt to changing conditions, such as fluctuating material prices. If iron ore prices rise by $10/ton, the system updates ROI projections to show the gyratory crusher’s higher throughput generates $20 million in additional revenue over 10 years, shortening ROI to 3 years. Many systems include a user-friendly dashboard, allowing non-technical staff to input data and view results (e.g., cost comparisons, capacity charts). A study of 50 quarries using these systems found they reduced selection errors by 40% and cut TLC by 5–10% compared to manual decisions.

Industry Application Cases Empirical Evidence

Real-world application cases provide practical insights into crusher selection, showing how theoretical parameters translate to on-site performance. These cases cover diverse industries—mining, recycling, construction—and highlight how factors like material type, project scale, and local regulations influence success. By examining actual outcomes (e.g., uptime, cost savings, quality compliance), readers can apply lessons to their own projects. This section explores four key case types, from large mining operations to cross-industry best practices, demonstrating the tangible impact of choosing the right crusher.

Large-Scale Mine Crushing Project Selection Case

A large iron ore mine processing 3 million tons/year (2,500 t/h) evaluated gyratory and jaw crushers. Initial analysis showed one gyratory crusher ( $2.5 million initial cost) could replace three jaw crushers ( $3.6 million total initial cost). Over two years, the gyratory crusher delivered 92% uptime (vs. 88% for jaw crushers) and reduced energy costs by $150,000/year. Its uniform discharge size also reduced screening workload by 25%, allowing the mine to reallocate two screening operators to other tasks. The gyratory crusher’s ROI was 3.2 years, vs. 4.8 years for the jaw crusher setup. Key success factors included matching the gyratory’s capacity to the mine’s 24/7 operation and using its wear-resistant liners to handle iron ore’s 280 MPa compressive strength.

Another case involved a copper mine with high moisture (18%) in ore. The mine initially tested a gyratory crusher but faced 15% capacity loss from clogging. Switching to a jaw crusher with a modified feed hopper (to reduce moisture buildup) improved uptime to 94% and eliminated $50,000/year in cleaning costs. The jaw crusher’s simpler design also made it easier to maintain in the mine’s remote location, where specialized gyratory crusher technicians were hard to hire. This case shows that material moisture—even in large mines—can override capacity advantages, making jaw crushers the better choice.

Renewable Resource Recycling Scene Application Practice

A C&D waste recycling plant processing 1 million tons/year (1,200 t/h) chose a jaw crusher for its ability to handle mixed materials (concrete, brick, metal debris). The jaw crusher’s toggle plate safety feature prevented damage from occasional metal pieces, reducing downtime by 3 days/year compared to a gyratory crusher (which would require costly repairs for metal impacts). The plant also customized the jaw crusher with a pre-screen to remove fines before crushing, reducing dust emissions by 70% and meeting local air quality standards. Operational costs were $0.95/t, 10% lower than a gyratory crusher’s projected $1.05/t, due to lower maintenance and parts costs.

Another recycling facility focused on asphalt waste (highly adhesive when warm) selected a jaw crusher with anti-stick liners. The liners—coated with a Teflon-like material—reduced material adhesion by 60%, eliminating 2–3 hours of daily cleaning needed with a gyratory crusher. This increased daily throughput by 50 t, adding $25,000/year in revenue. The jaw crusher’s compact footprint also allowed the facility to expand processing capacity within its existing 400-square-meter area, avoiding $200,000 in expansion costs. These cases show jaw crushers’ versatility in recycling’s variable material conditions.

Equipment Selection in Construction Waste Treatment

A construction waste treatment plant in an urban area (space-constrained, 250-square-meter processing yard) chose a mobile jaw crusher. The mobile jaw crusher’s tracked chassis allowed on-site processing, reducing transport costs by $8/ton (vs. hauling waste to an off-site plant). Its compact design (10 x 5 meters) fit the yard, while a mobile gyratory crusher (15 x 8 meters) was too large. The plant processed 500,000 tons/year (600 t/h) with 93% uptime, and the jaw crusher’s easy maintenance (liner changes every 4 months) kept operational costs at $1.00/t. The plant also added a magnetic separator to the jaw crusher to remove metal, increasing the value of recycled aggregate by $5/ton.

A rural construction waste plant with more space but limited budget opted for a stationary jaw crusher. Its $800,000 initial cost was 40% lower than a gyratory crusher’s $1.3 million, and its simple electrical system was easier to install in the plant’s remote location (where skilled electricians were scarce). The jaw crusher handled 300 t/h of mixed construction waste (concrete, wood, drywall) with 90% uptime, and its ability to tolerate contaminants (e.g., small wood pieces) reduced pre-processing time by 1 hour/day. Over 5 years, the plant saved $250,000 in initial costs and $150,000 in maintenance, proving jaw crushers’ cost-effectiveness for rural waste treatment.

Cross-Industry Crushing Equipment Selection Experience Sharing

Cross-industry experience shows that material hardness is the most consistent selection factor. A cement plant processing limestone (100 MPa) and a granite quarry processing granite (250 MPa) both used jaw crushers for limestone but switched to gyratory crushers for granite. The cement plant’s jaw crusher had $0.70/t operational costs for limestone, while the granite quarry’s gyratory crusher reduced costs by $0.20/t vs. a jaw crusher (due to longer liner life). This highlights that material hardness >200 MPa is a reliable threshold for choosing gyratory crushers.

Another cross-industry trend is prioritizing lifecycle cost over initial cost. A mining company and a recycling plant both found that paying 50% more upfront for a gyratory crusher (vs. a jaw crusher) saved 10–15% in TLC over 10 years. The mining company benefited from higher throughput, while the recycling plant (processing high-volume, hard concrete) benefited from lower maintenance. However, for operations with<5-year lifespans (e.g., temporary construction projects), jaw crushers are better: their lower initial cost avoids overinvesting in equipment that will be unused later. These shared experiences help standardize selection across industries, reducing trial-and-error costs.

Technological Development Trends and Cutting-Edge Applications

Emerging technologies are reshaping crusher design and selection, offering new ways to improve efficiency, reduce costs, and meet environmental standards. Composite crushing tech, 5G+IIoT, green manufacturing, and updated industry standards are no longer futuristic—they are practical tools that influence whether gyratory or jaw crushers are better suited for modern operations. For example, 5G-enabled remote monitoring reduces maintenance downtime for both crusher types, but gyratory crushers may benefit more from AI-driven performance optimization. This section explores these trends, explaining how they impact crusher capabilities and selection criteria for large-scale primary crushing.

Application of Composite Crushing Technology in Efficient Crushing

Composite crushing technology combines two crushing principles (e.g., compression + impact) to improve efficiency and particle quality. Some modern gyratory crushers integrate a pre-crushing zone (using impact force) and a main crushing zone (using compression), increasing capacity by 15–20% vs. traditional gyratory crushers. For example, a composite gyratory crusher processing 2,000 t/h of iron ore can reach 2,400 t/h, reducing the need for additional equipment. This technology also improves particle uniformity, cutting needle-shaped content to 5–8% (vs. 8–15% for standard gyratory crushers), making it ideal for high-spec aggregate production.

Composite jaw crushers add a secondary impact plate to the main crushing chamber, enhancing material breakdown and reducing discharge size variation to 1.8–2.2 (vs. 2.0–2.5 for standard jaw crushers). A quarry processing limestone with a composite jaw crusher saw 10% higher throughput and 15% lower energy consumption (1.1 kWh/t vs. 1.3 kWh/t). However, composite designs add complexity: composite gyratory crushers cost 20–30% more than standard models, and composite jaw crushers require more frequent impact plate maintenance (every 2 months vs. 3 months). For operations prioritizing efficiency over cost, composite tech is valuable; for budget-constrained sites, standard models remain better.

5G + Industrial Internet of Things (IIoT) Enabling Remote Equipment Monitoring

5G+IIoT allows real-time remote monitoring of crusher performance, reducing downtime and maintenance costs. Sensors on gyratory crushers track main shaft temperature, bearing vibration, and liner wear, sending data to a cloud platform via 5G. Operators can monitor performance from anywhere, and AI algorithms predict failures (e.g., a 10% increase in bearing vibration signals upcoming maintenance). A mine using this tech reduced gyratory crusher downtime by 30% (from 8 days/year to 5.6 days/year) and cut maintenance labor costs by $60,000/year.

Jaw crushers benefit from 5G+IIoT too: sensors monitor toggle plate stress and jaw plate wear, alerting operators to replace parts before failure. A C&D waste plant using remote monitoring for its jaw crusher extended liner life by 10% (from 4 months to 4.4 months) by optimizing feed rate based on real-time data. The plant also used IIoT to coordinate the jaw crusher with downstream conveyors, reducing material buildup and increasing throughput by 5% (30 t/h). While 5G+IIoT adds $50,000–$100,000 in initial setup costs, the average payback period is 1–2 years for both crusher types, making it a worthwhile investment for large-scale operations.

Equipment Design Optimization Under Green Manufacturing Standards

Green manufacturing standards (e.g., energy efficiency, recyclable materials) are driving crusher design changes. Modern gyratory crushers use high-strength, lightweight steel for the main frame, reducing weight by 15–20% and energy consumption by 5–8% (due to less material to move). For example, a lightweight gyratory crusher uses 0.9 kWh/t vs. 1.0 kWh/t for a traditional model, saving $10,000–$20,000/year in energy costs. These crushers also use 80% recyclable materials, meeting waste reduction targets and reducing end-of-life disposal costs by $30,000–$50,000.

Jaw crushers are optimized for green operations too: new models use variable-frequency drives (VFDs) to adjust motor speed based on feed rate, cutting energy use by 10–12% (1.1 kWh/t vs. 1.2 kWh/t). Some jaw crushers also integrate dust collection systems directly into the frame, reducing dust emissions by 85% and eliminating the need for separate dust control equipment (saving $20,000–$30,000). Green design adds 5–10% to initial crusher costs, but energy and waste savings often offset this within 3–4 years. For operations seeking carbon neutrality, these optimizations are critical: a green gyratory crusher reduces carbon emissions by 100–150 tons/year vs. a traditional model.

Industry Standard Development Progress and Compliance Risk Assessment

Industry standards for crushers are evolving to focus on safety, efficiency, and environmental impact. New standards (e.g., ISO 13854 for crusher safety) require enhanced guardrails and emergency stop systems, affecting both gyratory and jaw crushers. Gyratory crushers need additional guards around the rotating cone, adding $15,000–$20,000 to initial costs, while jaw crushers require reinforced safety covers for the eccentric shaft, adding $8,000–$12,000. Non-compliance risks fines of $10,000–$50,000 and operational shutdowns, making standard adherence essential.

Efficiency standards (e.g., EU Ecodesign Directive) set minimum energy performance levels: crushers must use<1.2 kWh/t for hard rock. Traditional jaw crushers (1.3–1.8 kWh/t) may need retrofits (e.g., VFDs) to comply, costing $30,000–$40,000. Gyratory crushers (0.8–1.2 kWh/t) already meet these standards, giving them an advantage in regions with strict efficiency regulations. Compliance risk assessment involves reviewing local standards (e.g., EU vs. North American) and planning for future updates: a crusher purchased today should meet standards for 5–10 years. For example, a mine planning to operate in the EU should choose a gyratory crusher that meets upcoming 2027 efficiency targets ( <1.0 kWh/t), avoiding costly retrofits later.

Maintenance, Service, and Operational Optimization

Even the best-selected crusher will underperform without proper maintenance and operational optimization. Maintenance ensures components like wear parts and lubrication systems function reliably, while optimization tailors operation to material conditions and production goals. Gyratory and jaw crushers have distinct maintenance needs—e.g., gyratory crushers require more frequent shaft inspections, while jaw crushers need regular jaw plate checks—and optimizing each type requires different strategies. This section explores how to extend crusher lifespan, reduce downtime, and maximize efficiency through targeted maintenance and operational adjustments.

Wear Part Lifespan and Replacement Cycle Management

Wear parts (e.g., liners, jaw plates) are the most frequently replaced components, and managing their lifespan reduces costs. For jaw crushers, movable jaw plates last 3–6 months in hard rock applications. Extending lifespan by 1 month saves $5,000–$8,000 (cost of a new set). Strategies include optimizing feed rate (avoiding overloading, which accelerates wear) and using high-chromium steel plates (which last 20–30% longer than standard steel). A quarry using high-chromium jaw plates extended replacement cycles from 4 months to 5 months, saving $12,000/year.

Gyratory crusher liners (concave and mantle) last 5–8 months in hard rock. Managing their lifespan involves monitoring wear depth with sensors (instead of manual inspections, which are less accurate) and rotating liners to distribute wear evenly. A mine using wear sensors extended liner life by 1 month, reducing replacement costs by $15,000/year. It also scheduled replacements during planned downtime (e.g., weekend shutdowns) to avoid unplanned stops, saving $20,000–$30,000 in lost production per replacement. For both crushers, storing spare wear parts on-site reduces lead time for replacements: a jaw crusher plant with spare jaw plates cuts replacement time by 4 hours, while a gyratory crusher plant with spare liners cuts it by 8 hours.

Lubrication System Optimization and Oil Selection Standards

Lubrication systems prevent overheating and wear in moving components (e.g., shafts, bearings). Jaw crushers use grease lubrication for the eccentric shaft, requiring regular grease checks (every 8 hours of operation). Optimizing the system involves installing automatic grease injectors, which deliver precise amounts of grease (avoiding over-lubrication, which attracts dust and causes clogging). A jaw crusher plant using automatic injectors reduced bearing wear by 25% and extended bearing life from 2 years to 2.5 years, saving $10,000–$15,000 in bearing replacement costs.

Gyratory crushers use oil lubrication for the main shaft and bearings, requiring strict oil quality control. Oil selection standards specify viscosity (e.g., ISO VG 68 for moderate temperatures) and contamination levels (<10 ppm of dirt). Using high-quality oil that meets these standards extends oil change intervals from 3 months to 6 months, saving $8,000–$12,000/year in oil costs. Optimizing the oil cooling system (e.g., adding a heat exchanger) keeps oil temperature <50°C, preventing oil degradation and reducing bearing failure by 30%. A mine using an optimized oil system for its gyratory crusher reduced bearing replacements by 1 per year, saving $25,000 in parts and labor.

Preventive Maintenance Model Development and Application

Preventive maintenance (PM) replaces reactive repairs, reducing downtime by identifying issues early. For jaw crushers, a PM model includes weekly checks of toggle plate tightness, monthly inspections of jaw plate wear, and quarterly bearing temperature tests. A C&D waste plant using this model reduced unplanned downtime by 40% (from 5 days/year to 3 days/year) and cut maintenance costs by $30,000/year. The model also uses historical data (e.g., jaw plate wear rates) to predict replacements, allowing the plant to order parts in advance and avoid delays.

Gyratory crushers need a more detailed PM model, including weekly main shaft vibration checks, monthly oil analysis, and bi-annual liner wear mapping. A mining company developed a PM model using AI to analyze sensor data (e.g., vibration, temperature) and predict failures. The model identified a failing bearing 2 weeks before it would have failed, allowing replacement during a planned shutdown and avoiding $50,000 in lost production. The company also scheduled PM tasks during low-demand periods (e.g., holiday weeks), minimizing impact on throughput. For both crushers, PM models have an average ROI of 2–3 years, making them a critical investment for large-scale operations.

Value of Remote Diagnosis Platforms in Fault Early Warning

Remote diagnosis platforms use real-time data and AI to detect faults early, reducing the need for on-site inspections. For jaw crushers, these platforms monitor toggle plate stress and jaw plate wear, sending alerts when values exceed thresholds (e.g., 10% above normal stress). A quarry using a remote platform received an alert about excessive toggle plate stress, which was caused by a misaligned feed hopper. Fixing the issue within 24 hours prevented toggle plate failure, saving $15,000 in repairs and 2 days of downtime.

Gyratory crusher remote platforms track main shaft vibration, oil pressure, and liner wear, providing detailed fault analysis (e.g., “vibration increase due to bearing misalignment”). A mine using this platform reduced on-site maintenance visits by 50% (from 24/year to 12/year), saving $40,000 in travel and labor costs. The platform also allows remote troubleshooting: technicians can access data from anywhere, reducing time to diagnose issues from 4 hours to 1 hour. During the COVID-19 pandemic, this was especially valuable, as remote diagnosis allowed maintenance to continue without on-site teams. For both crushers, remote diagnosis platforms reduce downtime by 20–30% and lower maintenance costs by 15–20%.

Policy Compliance and Standard Implementation

Policy compliance is non-negotiable for crusher operations, as regulations govern safety, environmental impact, data privacy, and carbon emissions. Standards like the EU WEEE Directive, OSHA safety rules, and carbon neutrality requirements shape crusher design, operation, and maintenance. Non-compliance risks fines, shutdowns, and reputational damage, so understanding and implementing these policies is critical when selecting and using gyratory or jaw crushers. This section explores key policies, how they affect both crusher types, and strategies to ensure compliance while maintaining operational efficiency.

Constraints of the EU WEEE Directive on Equipment Design

The EU WEEE Directive (Waste Electrical and Electronic Equipment) regulates the collection, recycling, and disposal of electrical equipment, including crushers (which have electrical components like motors and sensors). It requires crushers to be designed for easy disassembly—90% of components must be separable for recycling. For gyratory crushers, this means using bolted (not welded) frames and labeled components (e.g., “aluminum” vs. “steel”), adding $10,000–$15,000 to initial costs. Manufacturers also must provide recycling instructions, and operators must use authorized recycling facilities for end-of-life crushers, avoiding fines of $20,000–$50,000 for improper disposal.

Jaw crushers face similar design constraints: electrical components (e.g., VFDs) must be modular, allowing easy removal for recycling. A jaw crusher manufacturer redesigned its electrical system to meet WEEE requirements, reducing disassembly time from 8 hours to 4 hours and increasing recyclable material to 92% (vs. 85% for the old design). Operators in the EU must also track crusher waste, submitting annual reports to regulators. For example, a quarry using two jaw crushers submits a report detailing how 5 tons of old parts were recycled, ensuring compliance. While WEEE adds design and reporting costs, it also reduces environmental impact and aligns with circular economy goals.

Reflection of OSHA Standards in Operational Safety Protection

OSHA (Occupational Safety and Health Administration) standards set strict safety requirements for crusher operations, focusing on worker protection from moving parts and dust. For jaw crushers, OSHA requires guardrails around the feed hopper (height >1.2 meters) and emergency stop buttons within easy reach of operators. A C&D waste plant installing these guards reduced worker injuries by 60% and avoided OSHA fines of $12,000–$18,000. OSHA also mandates dust exposure limits (<5 mg/m³ of respirable dust), so jaw crusher operations need dust control systems (e.g., sprayers or vacuums), adding $15,000–$25,000 to setup costs but protecting workers’ health.

Gyratory crushers have additional OSHA requirements due to their rotating cone: guards must cover all moving parts, and lockout/tagout (LOTO) procedures must be in place for maintenance. A mine training workers on gyratory crusher LOTO procedures reduced lockout-related incidents by 80% and passed an OSHA inspection with no violations. OSHA also requires regular safety audits (at least annually), which for gyratory crushers include checking bearing temperature sensors and emergency stop functionality. While complying with OSHA adds safety equipment and training costs ( $20,000–$30,000/year), it reduces injury risks and avoids costly penalties—OSHA fines for crusher safety violations can reach $136,000 per violation.

Data Privacy Protection and Equipment Networking Compliance

With crushers increasingly connected to 5G+IIoT platforms, data privacy laws (e.g., EU GDPR, California CCPA) regulate how operational data is collected, stored, and used. These laws require operators to obtain consent for data collection (e.g., from maintenance technicians accessing remote data) and protect data from breaches. For gyratory crushers with remote monitoring, this means encrypting data (e.g., using AES-256 encryption) and limiting access to authorized personnel only. A mining company implementing these measures avoided a data breach that could have cost $100,000–$500,000 in fines and reputational damage.

Jaw crusher networking systems also need compliance: data on feed rates and maintenance schedules must be anonymized if shared with third parties (e.g., equipment manufacturers for troubleshooting). A quarry sharing jaw crusher data with a manufacturer used data masking (replacing identifying details with codes) to meet GDPR requirements. Operators must also retain data for a specified period (e.g., 2 years under GDPR) and provide data deletion options if requested. While data privacy adds IT costs ( $10,000–$20,000/year for security tools), it is essential for avoiding legal risks in an increasingly connected industry. For both crushers, compliance involves working with IT teams to implement secure data practices and train staff on privacy rules.

Innovation Requirements of Carbon Neutrality Certification on Manufacturing Processes

Carbon neutrality certification requires crushers to reduce greenhouse gas (GHG) emissions throughout their lifecycle—from manufacturing to operation to disposal. Manufacturing processes must use renewable energy (e.g., solar or wind power) to reduce embodied carbon: a gyratory crusher manufacturer using 100% renewable energy cut embodied carbon by 40% (from 50 tons CO₂ to 30 tons CO₂ per crusher). This meets certification requirements (e.g., ISO 14067 for carbon footprint) and makes the crusher more attractive to eco-conscious buyers.

Operational emissions are also critical: crushers must use energy-efficient designs and low-carbon fuels. A jaw crusher plant switching to renewable electricity (solar panels) reduced operational emissions by 50% (from 100 tons CO₂/year to 50 tons CO₂/year), helping it achieve carbon neutrality certification. Gyratory crushers, with their lower energy consumption (0.8–1.2 kWh/t), have an advantage: a gyratory crusher plant emits 20–30% less CO₂ than a jaw crusher plant of similar capacity. Disposal emissions are minimized by recycling 90% of crusher components, as required by certification standards. While achieving carbon neutrality adds costs ( $50,000–$100,000 for solar panels or renewable energy contracts), it also opens new markets—many large mining and construction companies now require carbon-neutral equipment suppliers. For both crushers, carbon neutrality is no longer an option but a business necessity in a low-carbon economy.