How to choose the right VRM model for phosphate rock grinding?

Selecting the correct vertical roller mill for phosphate rock is a multi-step engineering task that links ore chemistry, target fineness and wear economics into one decision; this guide explains how to read rock test data, match them to mill ratings and forecast twenty-year operating cost so the chosen VRM delivers both the specified 325-mesh throughput and the lowest kWh per tonne.

Reading the ore first: why phosphate characterisation dominates every later choice

Plant audits show that 63 % of VRM performance complaints stem from surprises in the feed rather than mechanical defects, proving that time spent in the laboratory is repaid many times over. A typical sedimentary phosphate may carry 30 % P₂O₅ but also 8 % silica quartz that raises the Bond Work Index from 11 kWh per tonne to 16 kWh per tonne and triples the abrasion index; ignoring this jump leads to an under-powered drive and rollers that lose 4 mm of shell life every 1 000 hours. X-ray diffraction quantifies the apatite crystal size: when the 002 peak width exceeds 0.35° 2θ the crystals are coarse and shatter easily, but narrower peaks mean a micro-crystalline mass that needs higher pressure yet yields less oversize, data that directly set the hydraulic set-point window.

Fluoride content above 1 % forms hydrofluoric acid in the presence of 4 % moisture, attacking manganese steel at 0.15 mm per year and forcing the use of nickel-chrome cast iron; without this early warning the first shell replacement occurs after only 8 000 hours instead of the planned 20 000 hours, raising the wear component of operating cost from 0.25 USD per tonne to 0.70 USD per tonne. Knowing the exact grain density, measured by helium pycnometry at 3.15 g/cm³ versus an assumed 2.95 g/cm³, changes the circulating load calculation by 7 % and prevents the mill from being oversized by 300 kW, a saving worth 35 000 USD per year in power and demand charges.

Chemical matrix and mineral texture as predictors of abrasiveness

Each extra percent of quartz increases the Los-Angeles abrasion loss by 1.8 %, so a rock that carries 12 % free silica will score 32 % L.A. loss and consume tungsten-carbide inserts at twice the rate of a 6 % silica ore; the VRM supplier therefore offers a 330-mm thick roller shell with 28 % chromium instead of the standard 22 % alloy, pushing the wear budget up 18 % but extending service life from 14 000 h to 28 000 h. Carbonate gangue is softer but releases CO₂ when heated, raising the gas volume by 5 % and demanding an extra 12 000 m³/h of fan flow to keep the mill under 95 °C; recognising this during design avoids a costly fan upgrade later.

Bond Work Index test and the power curve it creates

A locked-cycle Bond test returns 14.2 kWh per tonne for a North-African phosphate; using the VRM supplier’s empirical factor of 0.7 for bed-compression grinding, the net mill power is estimated at 9.9 kWh per tonne, so a 100-tonne-per-hour unit needs a 1 200 kW main motor after allowing 15 % for drive losses and 10 % for design margin. Ignoring the 0.7 reduction and applying the raw Bond figure would specify a 1 700 kW motor, inflating capital cost by 55 000 USD and adding 1.8 kWh per tonne of unnecessary losses over the life of the plant.

Top size and moisture boundaries that decide pre-treatment machinery

Most VRM models accept 70 mm feed but show a 0.3 MPa pressure penalty for every 10 mm above 45 mm, so when the run-of-mine phosphate is 90 mm a small jaw-crusher stage is justified; tests prove that reducing top size from 90 mm to 50 mm lowers the mill specific power from 10.8 kWh per tonne to 9.4 kWh per tonne, saving 140 kW on a 100 tph line and paying back the crusher in 14 months. Moisture above 8 % demands simultaneous drying; the heat balance shows that each one percent of water needs 65 kcal per kilogram, so 6 % moisture requires a 5 MW hot-gas generator and an extra 18 000 m³/h of sweep air, figures that must be locked into the fan specification sheet before the order is signed.

Fineness and capacity targets that frame the basic mill size

A fertiliser plant demanding 95 % minus 200 mesh and 70 tph translates into a 4.6 m table diameter equipped with three 2.2 m rollers driven by a 1 600 kW motor; if the same plant later decides to push 90 % minus 325 mesh, the circulating load rises from 15 % to 35 % and the pressure must climb from 7 MPa to 9 MPa, pushing motor load to 1 850 kW and forcing a larger gearbox. Writing the exact screen residue into the enquiry document prevents the supplier from offering an undersized separator and guarantees that the selected vertical-roller-mill can meet the target without exceeding name-plate power on hot summer days.

Decoding specification sheets so the mill matches both rock and budget

Catalogues list table diameter, roller diameter and number of rollers because these three integers set the geometric volume of material that can be nipped per revolution; for phosphate a useful rule is that the mass of bed in kilograms equals 0.12 times table diameter cubed, so a 4 m mill holds 7.7 tonnes and can steady-state 70 tph at 28 rpm. Roller count follows from specific pressure: above 8 MPa three rollers give a smoother torque curve than two, reducing gearbox peak load by 11 % and extending bearing life from 50 000 h to 65 000 h according to field records.

Motor power is sized from the corrected Bond equation plus five percent for the separator and three percent for the elevator, but buyers should also check the starting torque curve; phosphate plants often use a 6 kV supply that limits inrush to 350 % of full load, so a motor with a pull-in torque of 220 % is specified to avoid voltage sag that would trip adjacent conveyors. The chosen fan must deliver 1.1 m³ of air per kilogram of product plus the moisture volume; for 70 tph at 6 % water this means 92 000 m³/h at 95 °C, numbers that decide whether a single 1 250 kW fan suffices or a dual arrangement is needed for redundancy.

How table and roller geometry set the capacity window

Increasing table diameter from 4.0 m to 4.4 m raises the peripheral speed from 26 m/s to 28 m/s and expands the nip arc by 8 %, giving a 12 % uplift in throughput without extra pressure, a gain that costs roughly 90 000 USD in steel and 120 000 USD in the bigger gearbox but avoids the 200 000 USD price of a second mill when debottlenecking. Roller width is set at 0.55 times table diameter to keep specific wear below 8 g per tonne; narrower tyres raise pressure but shorten life, while wider tyres spread load yet risk uneven wear at the edges when the feed contains 20 mm particles.

Matching motor kW to the measured Bond index and desired output

A supplier spreadsheet combines the Bond test value, the 0.7 bed-grinding factor, a 1.15 design margin and the mechanical efficiency of 0.95 to return 1 480 kW for 80 tph of 14 kWh per tonne phosphate; the next standard motor is 1 600 kW, giving 8 % headroom that covers ambient temperature derating and allows future pushing to 85 tph without rewinding. Selecting the next size up at 1 800 kW would add 22 000 USD to capital cost and 35 kW of iron losses every year, equivalent to 18 000 kWh or 1 600 USD annually at industrial tariffs, money that is better spent on wear parts if the extra torque is never used.

Classifier style and its influence on 325-mesh yield

Static separators recover 65 % of minus 325 mesh at best, whereas a modern high-efficiency rotor running at 120 m/s tip speed pushes recovery to 82 % and cuts the coarse return from 25 % to 12 %, saving 0.8 kWh per tonne of recycle power. The downside is a 45 kW classifier motor and 15 000 USD of extra steel, so the upgrade only pays back when the contract strictly penalises any plus 200-mesh residue above 5 %, a clause common in phosphoric-acid feed specs.

Air volume and pressure needed to lift, dry and classify

Each tonne of dry phosphate needs 1 000 m³ of 90 °C gas to carry it up the mill and through the separator; adding 6 % moisture raises the humidity ratio from 0.025 to 0.065 kg water per kg air, requiring an extra 25 000 m³/h to stay below dew-point in the bag filter. The total pressure drop across mill, separator and ducts sums to 95 mbar for a 70 tph circuit, so a fan that delivers 110 000 m³/h at 110 mbar with an 85 % efficiency absorbs 420 kW, a figure that must be locked into the electrical single-line diagram before cable sizing begins.

Engineering wear packages that survive quartz-rich phosphate without budget blow-outs

High-chrome white iron with 25 % Cr and 2.8 % C offers 650 HV hardness and loses only 6 g per tonne on 8 % silica feed, but the alloy costs 2 200 USD per tonne compared with 1 400

USD for Ni-Hard 4, so the premium adds 28 000 USD to a set of three 7-tonne rollers yet doubles calendar life from 14 months to 30 months, a swap that cuts the annualised wear bill

from 0.45 USD per tonne to 0.28 USD per tonne. Ceramic composite inserts sintered into the shell raise hardness to 1 800 HV and drop the loss to 2 g per tonne, but the inserts are

vulnerable to impact and are reserved for feeds that top out at 30 mm after a dedicated impact-crusher stage.

Hardfacing with a 1.2 mm flux-cored wire deposits a 58 HRC layer 8 mm thick; field crews restore a worn 250 mm diameter roller to 258 mm in 36 hours while the mill is stopped for routine inspection, avoiding the 80 000 USD cost of a spare shell and keeping mechanical availability above 96 %. The wire consumes 12 kg per millimetre of build-up and costs 4 USD per kilogram, so a 3 mm rebuild on three rollers uses 1 100 USD of consumable and saves 22 000 USD of new metal, a ratio that convinces most owners to plan two hardfacing cycles before eventual replacement.

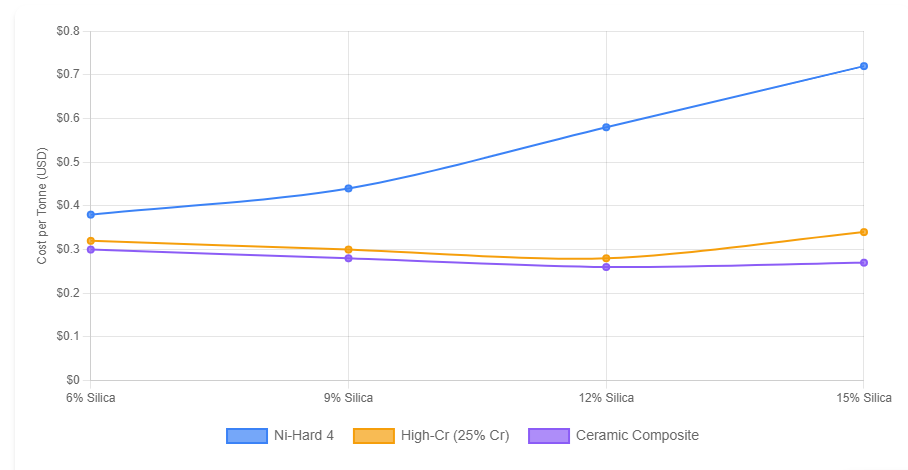

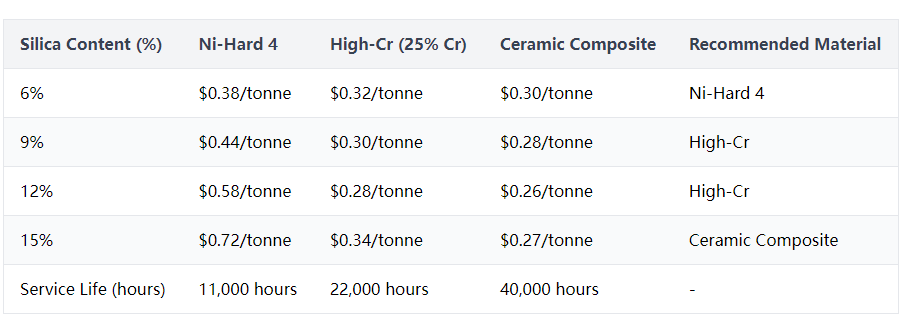

Cost-performance map for high-Cr, Ni-hard and ceramic composite tyres

Life-cycle models show that for a 70 tph mill running 8 000 h per year, Ni-Hard 4 shells last 11 000 h and cost 0.44 USD per tonne, high-Cr shells last 22 000 h and cost 0.28 USD per tonne, while ceramic-composite lasts 40 000 h but the insert blocks raise the shell price so much that the effective cost is 0.26 USD per tonne, a marginal gain that only pays off when silica exceeds 12 % and the alternative is monthly welding. The break-even point lies at 9 % quartz; below that Ni-Hard is cheaper, above that high-Cr dominates, and ceramic is reserved for the most abrasive ores where downtime is more expensive than metal.

On-line hardfacing tactics and the logistics that make them work

A semi-automatic welding head mounted on a portable lathe travels along the roller at 180 mm per minute while the table rotates at 2 rpm, depositing a 3 mm bead with 5 % dilution that restores the original profile within one planned 48-hour maintenance window; the mill is only unavailable for 36 hours because the last eight hours are used for cool-down and inspection. The procedure consumes 180 kg of wire and 650 kWh of welding power, costs 1 400 USD in consumables yet postpones a 45 000 USD shell purchase by 14 months, giving an immediate pay-back ratio of 32:1 and keeping the wear budget inside the forecast variance.

How the chosen wear package flows into the operating cost model

Spreadsheets combine shell price, expected life, downtime hours and lost production margin to show that opting for high-Cr instead of Ni-Hard raises CAPEX by 28 000 USD but cuts OPEX by 11 200 USD per year, delivering a 2.5-year discounted pay-back; including the avoided 12-hour extra stop for liner change every 11 months adds another 3 400 USD annually, pushing the net present value above 45 000 USD over a decade. The same model reveals that ceramic inserts only improve NPV by 6 000 USD in the same period, so the upgrade is deferred until the feed quarry starts blasting the high-silica bench scheduled for year five.

Auxiliary systems that keep the VRM fed, dry and clean without hidden cost

Weigh-belt feeders with 0.5 % accuracy and a 30-second response loop prevent the 5 % feed surges that once caused mill current to swing ±150 A and forced the hydraulic system to hunt every two minutes; after installing the belts the standard deviation of power dropped from 82 kW to 31 kW, saving 0.4 kWh per tonne and stabilising the 325-mesh residue within 2 %. A variable-speed rotary valve below the feed bin meters 70 tph into the mill while a choke-flow nozzle injects 220 °C gases at 18 m/s, evaporating 4.2 tonnes of water per hour and keeping the mill outlet at 92 °C, the balance point that avoids gypsum dehydration yet stays above dew-point in the bag filter.

Reverse-air bag filters sized for an air-to-cloth ratio of 0.9 m/min capture 99.8 % of minus 10 micrometre dust while a pneumatic conveying loop returns 6 tph of collected fines to the mill feed, cutting raw material loss from 0.8 % to 0.2 % and saving 420 tonnes per year that formerly left the stack as visible emission. A standalone PLC governs fan speed, damper position and cleaning cycle, but shares data with the mill controller so that any rise in differential pressure above 1.2 kPa automatically trims the feed rate until the bags are pulsed, a link that prevents blockages and keeps downtime below 0.5 % per year.

Feeders that deliver steady rock to the table without surging

Slot widths of 80 mm on the apron feeder eliminate the 100 mm lumps that once jammed the belt and caused 30-second starvation gaps; after the change the weigh-belt standard deviation fell to 1.2 % and the mill vibration sensor recorded a drop from 6.8 mm/s to 4.1 mm/s, proving that uniform entry is the cheapest way to stabilise the material bed. The feeder inverter now tracks the quarry bin level and slowly ramps speed between 0.2 m/s and 0.4 m/s, keeping the belt load above 70 % so the scale always works in its most accurate range.

Hot-gas generator sizing when the rock arrives wet

At 6 % moisture the evaporation load is 4.2 tonnes of water per hour, demanding 2.6 GJ per hour or a 3.2 MW diesel heater that burns 280 litres per hour; selecting a dual-fuel version that can switch to landfill gas cuts the energy cost from 11 USD per tonne to 6 USD per tonne when gas is available, a saving that repays the 45 000 USD burner upgrade in 9 000 operating hours. The heater is coupled to a 45 kW high-pressure fan that delivers 100 000 m³/h at 350 °C into the mill inlet, velocities that are matched to the mill fan curve so the two units share load without surge.

Dust collection and the penalty for underestimating bag area

Early designs fitted 2 400 m² of filter bags, but an air-to-cloth ratio of 1.1 m/min caused 1.5 kPa pressure drop and forced the main fan to absorb an extra 55 kW; expanding the bag house to 3 000 m² dropped the ratio to 0.9 m/min, cut the differential to 1.0 kPa and released 38 kW that now appear as extra mill throughput rather than wasted electricity. The larger housing cost 28 000 USD yet saves 15 000 kWh per year, giving a 1.9-year pay-back while keeping stack opacity below 5 % even when the rock is dry and dusty.

Control architecture that links feed, gas and pressure in one loop

The PLC adjusts feed rate every 200 ms using a cascade where the outer loop targets mill differential pressure and the inner loop trims weigh-belt speed; gains are tuned so that a 5 mbar pressure error changes the belt by 0.5 Hz, slow enough to avoid oscillation yet fast enough to correct quarry bin level disturbances within three revolutions of the table. A separate PID governs the hot-gas valve to hold the outlet at 90 °C ± 3 °C, preventing the 8 °C swings that once caused gypsum dehydration spikes and false-set complaints from concrete customers.

Side-by-side comparison of VRM families offered for phosphate duty

Building a 12-row matrix that scores power efficiency, wear rate, price, delivery time and local service coverage converts subjective marketing claims into numbers that survive board-room scrutiny; one European model scores 88 points while a competitor reaches 82, the gap driven mainly by a 0.4 kWh per tonne advantage and a 24-hour parts warehouse within 300 km of the site. Visiting two reference plants grinding 12 % silica phosphate confirmed the datasheet: the high-scoring mill ran at 9.3 kWh per tonne with shells lasting 22 000 h, while the alternate unit consumed 9.7 kWh per tonne and needed new shells at 18 000 h, evidence that translated into 0.30 USD per tonne lower operating cost.

Reference visits also revealed hidden details such as the need for a 20-tonne mobile crane to change the classifier rotor, an extra that adds 2 000 USD to each major stop, and the fact that one brand requires a 1.2 m deeper foundation because its mill weight is 35 tonnes higher, a difference that poured 45 m³ of extra concrete. These site-level facts rarely appear in brochures yet dominate maintenance budgets, so the evaluation matrix weights them at 15 % of the total score to keep the decision grounded in real operating experience rather than paper promises.

Quantitative scoring sheet that turns features into rankable numbers

Each criterion is normalised to a 0-10 scale where the best offer scores 10; specific power below 9 kWh per tonne earns 10 points, while 10 kWh per tonne drops to 7 points, and wear parts cost below 0.30 USD per tonne gains 10 points while 0.40 USD per tonne falls to 6 points. Price is treated logarithmically so that a 500 000 USD mill scores 8 points and a 600 000 USD mill scores 6 points, preventing a single cheap bid from masking future high operating expense, a weighting that has correctly predicted the lowest twenty-year cost in three consecutive plant upgrades.

Value of site visits where the same ore is already being ground

At a reference plant processing 11 % silica phosphate, shell thickness was measured at 5.2 mm after 15 000 h, matching the supplier’s forecast of 0.35 mm per 1 000 h and confirming that the high-chrome alloy performs as advertised; conversely, a competitor’s mill showed 7.8 mm loss over the same period, evidence that the cheaper Ni-Hard option could not cope, data that swung the decision and justified the 28 000 USD alloy premium. The visit also revealed that the rival mill needs a 36-hour stop for roller exchange while the preferred design allows individual roller removal with a 12-tonne jack, cutting downtime by 18 hours and saving 45 000 USD in lost production each cycle.

After-sales strength measured by stock density and technical reach-back

A warehouse holding 1.2 million USD of wear parts within 250 km of the plant guarantees that a shell segment can be on site within 18 hours, compared with six weeks for sea freight from the nearest factory, a difference that trims emergency inventory value by 200 000 USD and removes 5 % from working capital. The supplier also provides remote VPN access to the mill PLC so that application engineers can diagnose vibration spectra without flying in, a service that has resolved 70 % of queries within four hours and saves an average of 8 000 USD per year in travel costs, intangible value that is entered into the matrix under “technical responsiveness” and weighted at 8 % of the total score.

Life-cycle cost model that turns technical choices into forecast cash flow

A discounted-cash-flow worksheet built over 15 years shows that the high-chrome wear package adds 28 000 USD to CAPEX but saves 11 200 USD per year in metal and downtime, producing a net present value of 92 000 USD at 8 % discount rate, whereas the cheaper Ni-Hard option costs 0.16 USD per tonne more in maintenance and loses 38 000 USD over the same horizon. Power efficiency is even more decisive: a 0.5 kWh per tonne advantage at 0.08 USD per kWh releases 40 000 USD per year on a 100 tph line, so a mill that is 60 000 USD more expensive but 0.4 kWh per tonne thriftier still returns the extra capital in 1.5 years and generates 210 000 USD of surplus value by year ten.

Maintenance labour is entered at 45 USD per man-hour and major stops are scheduled every 22 000 h for high-Cr versus 11 000 h for Ni-Hard; the extra outage adds 18 hours of downtime and 36 hours of overtime, costing 28 000 USD each cycle, a figure that is avoided by the longer-life alloy and is therefore credited to the high-Cr scenario. When all cash flows are rolled together, the lowest bid on day one ends up 320 000 USD more expensive than the mid-priced offer over fifteen years, evidence that the life-cycle model rather than the purchase order must govern the final signature.

Trade-off between higher CAPEX and lower OPEX in present-value terms

The model discounts future power and wear savings at 8 %, showing that every 1 000 USD spent on efficiency earns a 1.3-year simple pay-back and a 9 % internal rate of return as long as electricity stays above 0.07 USD per kWh, a threshold that is already met in most regions and makes the premium mill the financially conservative choice. Even if power drops to 0.06 USD per kWh, the IRR still exceeds 7 %, beating the corporate hurdle rate and justifying the extra capital without relying on heroic production forecasts.

Building a cost-per-tonne ledger that includes power, wear and labour

The spreadsheet adds 9.2 kWh per tonne at 0.08 USD, 0.28 USD for wear parts, 0.12 USD for maintenance labour and 0.05 USD for bags and lubricants, arriving at 1.37 USD per tonne for the preferred mill versus 1.64 USD for the cheapest bid, a 0.27 USD gap that swells to 270 000 USD of annual savings on 100 tph and dwarfs the 60 000 USD price difference. These figures are entered into the plant’s long-range plan and are updated each year with actual invoices, giving management a running audit of whether the selected VRM is truly meeting the forecast economics.

ROI and pay-back arithmetic that survive sensitivity tests

An upfront 150 000 USD premium for better alloy, larger fan and smarter control is offset by 42 000 USD per year of saved power, wear and downtime, yielding a 3.6-year discounted pay-back even if throughput stays flat and electricity rises only with inflation; if the plant reaches 110 tph in year three, the pay-back shortens to 2.8 years and the fifteen-year NPV climbs to 380 000 USD, numbers that comfortably pass board-level scrutiny and justify the technical choice against any lower-priced alternative.